No one wants to be cornered in a situation where they’d be unable to provide for their loving pet. We are well aware that there hasn’t been one documented instance when a cat has obeyed its owner, but being proactive, instead of brushing off the unthinkable can potentially save you a lot of heartache and worry.

That’s where cat insurance comes in.

Our mousers might think that they have nine lives, but it’s up to us to be at the ready when they jump from unimaginable heights, eat everything from the trash can, or wander off to the wilderness of the asphalt jungle. These days, there are a plethora of insurance plans available at your fingertips. In fact, there are so many that one is sure to get option paralysis browsing through the endless sites, blogs, forums, forums for blogs, blogs for forums, you name it.

You can go as deep as the rabbit hole will take you and still end up not knowing which provider and plan best suits your and your feline’s needs. To make things clearer and less time-consuming, we’ve made a list and gone through the best cat insurance companies on the market today.

List of the Best Cat Insurance Companies on the Market

We’ve compiled an extensive list of cat insurance providers, so please take your time and see what suits you best.

In the provided table below, and the reviews that follow, you’ll be able to view and compare the company’s rating, pros, and cons. A pricing quote chart for each company will also be included, providing insight into their monthly premium offers for several popular breeds.

Summary Table

| Company | Average Monthly Premium Price* | Claim Limit Options | Deductible | Reimbursement |

|---|---|---|---|---|

| Nationwide | $35 | $10.000 – Unlimited, Benefits Schedule | $250 | 50%, 70%, 90% |

| Embrace | $36 | $5,000 – Unlimited | $200 – $1,000 | 70%, 80%, 90% |

| Healthy Paws | $32 | Unlimited | $100 – $1,000 | 50%, 60%, 70%, 80%, 90% |

| ASPCA | $44 | $3,000 – $10,000 | $100 – $500 | 70%, 80%, 90% |

| Figo | $40 | $5,000 – Unlimited | $100 – $1,500 | 70% – 100% |

| VPI | $63 | $10.000 – Unlimited, Benefits Schedule | $250 | 50%, 70%, 90% |

| Progressive | $37 | $5,000 – Unlimited | $50 – $1,000 | 70%, 80%, 90% |

| Trupanion | $72 | Unlimited | $0 – $1,000 | 90% |

| GEICO | $47 | $5,000 – Unlimited | $200 – $1,000 | 70%, 80%, 90% |

| Bivvy | $11 | $1,000 – $5,000 | $50 – $250 | 50% |

| AKC | $48 | $3,000 – $10,000 | $100 – $1,000 | 70%, 80%, 90% |

| USAA | $46 | $5,000 – Unlimited | $200 – $1,000 | 70%, 80%, 90% |

| Petplan | $51 | $5,000 – Unlimited | $250 – $500 | 70%, 80%, 90% |

| Petco | $43 | $5,000 – Unlimited | $100 – $500 | 70%, 80%, 90% |

| State Farm | $70 | Unlimited | $0 – $1,000 | 90% |

| Hartville | $35 | $2,500 – $10,000 | $100 – $500 | 70%, 80%, 90% |

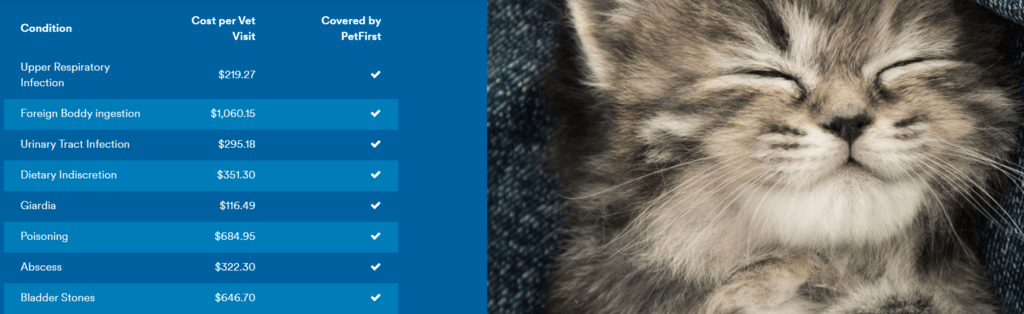

| PetFirst | $28 | $2,000 – $10,000 | $50 – $500 | 70%, 80%, 90% |

| Pets Best | $37 | $5,000 – Unlimited | $50 – $1,000 | 70%, 80%, 90% |

| 24PetWatch | $32 | $5,000 – $20,000 | $100 – $1,000 | 80% |

| Prudent Pet | $33 | $10,000 – Unlimited | $100 – $1.000 | 70%, 80%, 90% |

| SPOT | $33 | $2,500 – Unlimited | $100 – $1,000 | 70%, 80%, 90% |

| PetPartners | $42 | $1,000 – Unlimited | $100 – $1,000 | 70%, 80%, 90% |

| PetPremium | N/A | $3,000 – $10,000 | $100 – $500 | 70%, 80%, 90% |

| Pumpkin | $41 | $7,000 or $15,000 | $100 – $500 | 90% |

| Eusoh | $65 | $8,500 | $250 | 80% |

| Pet Assure | 25% discount | Unlimited | $0 | 25% |

| Allstate | $46 | $5,000 – Unlimited | $200 – $1,000 | 70%, 80%, 90% |

| MetLife | $28 | $2,000 – $10,000 | $50 – $500 | 70%, 80%, 90% |

| Costco | N/A | $7,500 – $15,000 | $300 – $500 | 70%, 80%, 90% |

| AAA | $32 | Unlimited | $100 – $750 | 60%, 70%, 80%, 90% |

| AARP | $39 | $5,000 – Unlimited | $250 – $500 | 70%, 80%, 90% |

| Liberty Mutual | $34 | $5,000 – Unlimited | $100 – $500 | 70%, 80%, 90% |

| VCA | $50 | Unlimited | $0 | 100% |

| Lemonade | $80 | $5,000 – $100,000 | $100 – $500 | 70%, 80%, 90% |

| APIC | $67 | $1,000 – Unlimited | $0 – $1,000 | 70%, 80%, 90% |

| Wells Fargo Health Advantage | Full vet bill | Unlimited | $0 | Credit-based payment |

| Banfield | N/A | Unlimited | $0 | 100% |

| AAHA | $41 | $5,000 – Unlimited | $250 – $500 | 70%, 80%, 90% |

| Wagmo | $61 | $20,000 | $500 – $1,000 | 100% |

| Odie | $371 | $5,000-$40,000 | $50 – $1,000 | 70%, 80%, 90% |

| Companion Protect | $32 | $100,000 | $50 for in-house vets$100 for other vets | 90% for in-network vets80% for other vets |

| TrustedPals | N/A | $4,000 – Unlimited | $0 – $750 | 70%, 80%, 90%, 100% |

| Pawp | $19 | $3,000 | $0 | 100% |

| Toto | $43 | $2,500 – $15,000 | $100 – $500 | 70%, 80%, 90% |

*Prices vary depending on the cat’s breed, age, gender, and location. The above prices reflect a monthly premium for a mixed breed 5-year-old male cat based in New York.

Now, let’s take a closer look at the companies and what they offer.

1. Nationwide

- AM Best Rating: A+

- BBB Rating: A+

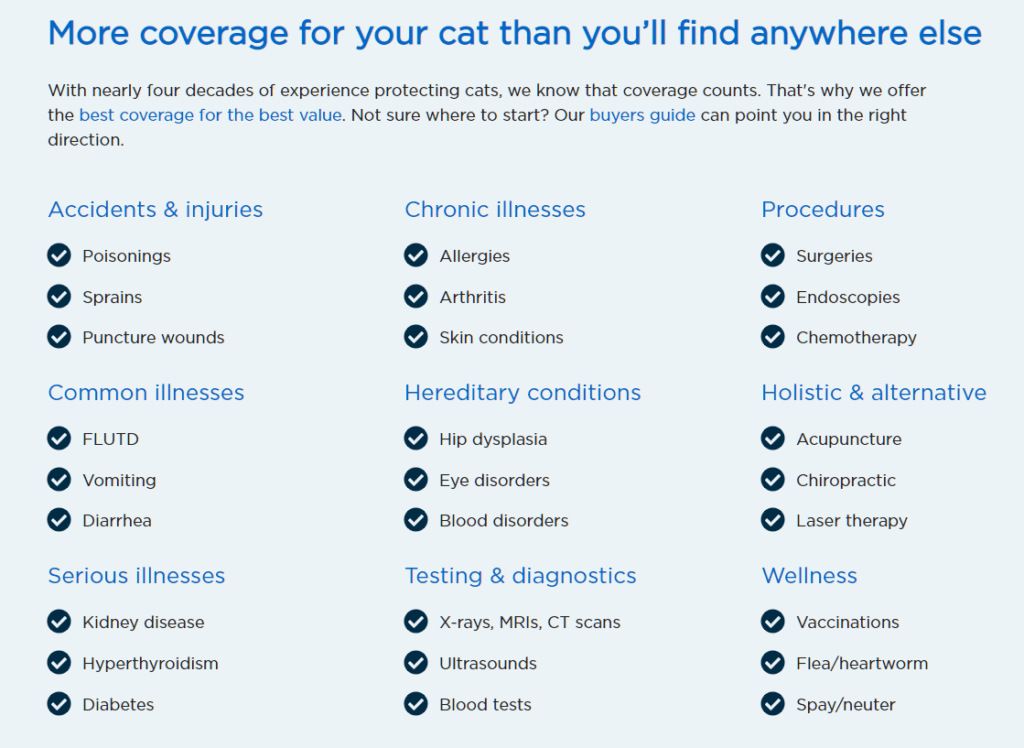

Nationwide is one of the longest-standing companies in the pet industry and offers a large variety of plans and options, regardless of your cat’s breed, gender, age, or size.

Their plans include coverage for everything from common illnesses and chronic diseases to holistic and alternative treatments. They impose no bilateral conditions, reimburse up to 90% of your vet bill, and you don’t have to worry about taking your cat with you when traveling because your insurance is valid anywhere in the world.

Pros

- Coverage for accidents, illnesses, and wellness;

- Whole Pet with Wellness plan comes with a 90% reimbursement percentage;

- Bilateral conditions are covered;

- Exam period is not required;

- Cats are covered for accidents and illnesses anywhere in the world.

Cons

- No coverage for pre-existing conditions and grooming;

- Boarding/grooming, cosmetic procedures, and breeding are not covered.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $61.08 | $53.12 | $83.03 |

Read the full Nationwide Pet Insurance review.

2. Embrace

- AM Best Rating: A+

- BBB Rating: A+

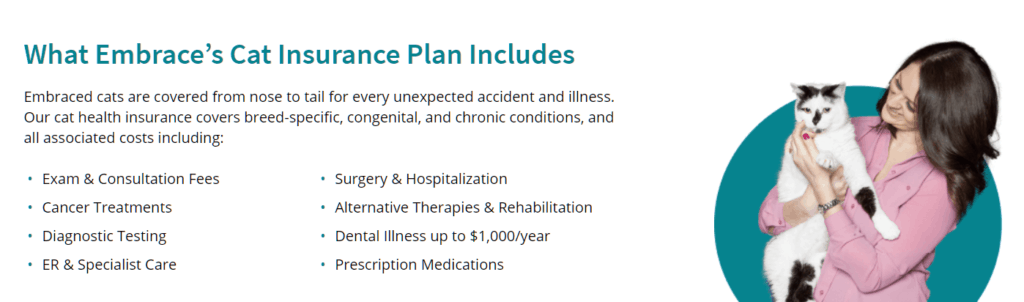

Embrace is well known for its Wellness Rewards program, which includes oral health, massages, vaccines, and more. Each year you don’t submit a claim with Embrace, they decrease your annual deductible by $50.

Their policies distinguish between curable and incurable pre-existing conditions, covering curable ones after your pet is symptom-free for 12 months.

Pros

- Annual deductible ranging from $200 to $1,000;

- Top-industry Wellness Rewards plan;

- Medical history review;

- Worldwide cat travel insurance;

- 5% discount for military and 10% discount for multiple pets;

- $50 decrease on deductible if you go claim-free for a full year.

Cons

- Bilateral conditions aren’t covered (not suitable for felines that have or are prone to cruciate ligament problems);

- Cosmetic procedures, DNA testing, breeding, and pregnancy are not covered.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $500 | $500 | $500 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $62.33 | $45.29 | $36.88 |

3. Healthy Paws

- AM Best Rating: A++

- BBB Rating: A+

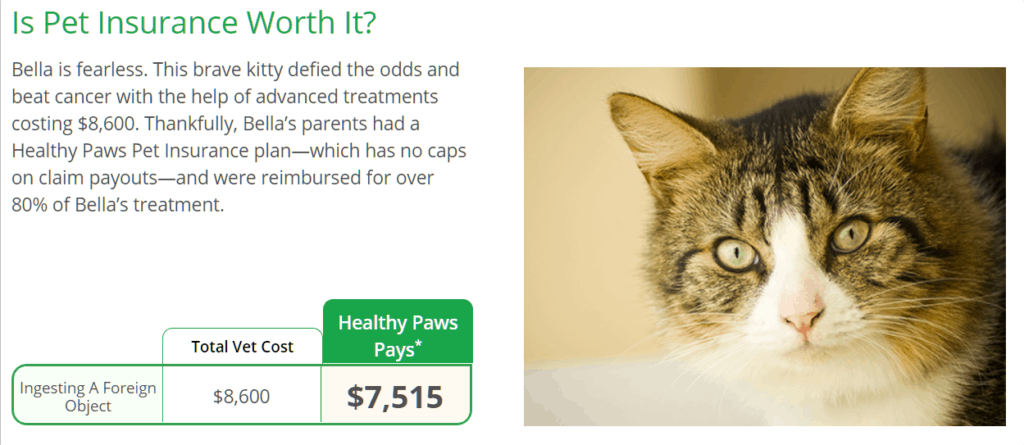

You might want to choose Healthy Paws because of their altruistic Every Quote Gives Hope™ donating program that deals with animals in need of shelter and basic healthcare.

However, the thing that really makes them stand out from the crowd is their unlimited coverage; be it annual or lifetime. They offer direct bill payments, as well as direct, uninterrupted transfers of the insurance policy to someone else.

Pros

- The average claim processing is 48 hours;

- Regular donations on every quote for homeless animals;

- Direct vet bill payment;

- Option to your policy transfer to another person without interruption;

- No per-incident, annual, and lifetime limits on coverage.

Cons

- The examination fees for pre-existing conditions and preventative care are not covered.

- The plan does not reimburse the costs, fees, or expenses associated with elective procedures, boarding, behavioral modification, training, therapy, or medications for behavioral modification.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 6 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | Unlimited | Unlimited | Unlimited |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $26.24 | $35.11 | $31.85 |

4. ASPCA Cat Insurance

- AM Best Rating: A

- BBB Rating: A+

The ASCPA is a wonderful organization working tirelessly to diminish animal cruelty and help those in need. With the exception of knee and ligament conditions, ASPCA also offers cat insurance through ASPCA Pet Health Insurance, which is great because it allows for pre-existing conditions coverage if your cat has been healthy for 6 months.

The company also boasts decent claim processing times, options for direct vet bill payments, and even offers coverage for vaccines, tick and flea prevention, and dental cleanings.

Pros

- 30-day money-back guarantee.

- No age limit;

- Less than ten days on average for claim processing;

- Extended coverage for curable pre-existing conditions;

- Direct vet bill payment;

- Comprehensive wellness plan;

- Accident-only plan.

Cons

- ASPCA cat insurance plans aren’t very flexible. You can only customize your policy once per year;

- Illness and accident coverage have a 14-day waiting period.

- The plans do not cover elective procedures, such as tail docking, ear cropping, and claw removal.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $40.44 | $38.62 | $79.98 |

5. Figo

- AM Best Rating: A-

- BBB Rating: B

If flexibility and affordability is what you’re after, you should give Figo some serious consideration. They offer comprehensive cat health coverage that is connected to a smartphone app that links you to a community of cat owners.

Furthermore, Figo reimburses claims quickly and up to 100% – something that is hard to find in today’s industry.

Pros

- Extremely flexible cat insurance policies with annual deductible starting at $100 and capping at $1,500;

- Reimbursement percentages from 70% up to 100%;

- Annual claim limits ranging from $5,000 to unlimited;

- 10% discount for multiple pets.

- The Figo Pet Cloud app is a all-around solution for keeping up on the latest;

- Around the clock live vet access.

Cons

- Lack of a wellness plan option; routine, wellness, or preventative care;

- Exclusions for bilateral conditions and behavioral therapy;

- $2 monthly transaction fee if you don’t pay for a full year.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $39.80 | $32.52 | $46.55 |

6. VPI

- AM Best Rating: A+

- BBB Rating: A+

Today, Veterinary Pet Insurance is a subsidiary of Nationwide. The merger was completed in 2009, so all of their insurance policies are administered as part of Nationwide Insurance. VPI was the very first US company to sell pet insurance back in 1982.

It’s important to know that they offer a vet helpline – live veterinary guidance about your cat’s health, from general questions to identifying urgent care needs.

Pros

- Extensive coverage for accidents, illnesses, wellness, routine, and preventive care;

- Option for unlimited claim payout and 90% reimbursement rate;

- Coverage for bilateral conditions;

- Exclusive plans and discounts are available to employees.

- Worldwide travel insurance;

- Live vet helpline;

Cons

- No coverage for pre-existing conditions and grooming;

- Boarding/grooming, cosmetic procedures, and breeding are not covered.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $61.08 | $53,12 | $83.03 |

7. Progressive

- AM Best Rating: A+

- BBB Rating: A+

Progressive provides its insurance plans through Pets Best. They have inclusive and diverse plans regarding wellness, accidents, and illnesses.

They also offer an all-around wellness plan for cats with their EssentialWellness and BestWellness routine care plans for kittens, including routine check-ups, shots and vaccinations, urinalysis, deworming, FELV screenings, and more.

If you have auto insurance through Progressive, you can be reimbursed up to $1,000 on your veterinary costs if you have a cat injured in a car accident.

Pros

- Affordable BestBenefit Accident and Illness Plan;

- Accident-Only Plan available;

- Optional Wellness Routine Care Plan;

- Option for direct vet bill payment;

- Customizable policies;

- Extra benefits for accidents with every auto insurance policy.

Cons

- No coverage for exam fees, cremation, or burial services;

- Does not cover non-veterinary expenses such as taxes, administration fees, waste disposal fees, transportation fees, shipping and handling fees, bathing, and grooming.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | Unlimited | Unlimited | Unlimited |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $31.68 | $24.28 | $95.89 |

8. Trupanion

- AM Best Rating: Unrated

- BBB Rating: A

Trupanion offers a very detailed and transparent overview of all their policies so that nothing can come as a surprise at a later date; you know exactly what you are getting and when you are eligible for reimbursement.

Their direct payment option, as well as their dental and bilateral conditions coverage are some of the most notable features that make Trupanion stand out from the crowd.

Pros

- Dental care insurance;

- 30-day money-back guarantee.

- Full coverage on bilateral conditions;

- Deductible can be as low as $0;

- 90% reimbursement rate on an unlimited claim coverage;

- Options for physical therapy, acupuncture, hydrotherapy, and behavioral therapy.

Cons

- Trupanion only has per-incident deductibles which are much costlier; no annual deductible.

- Wellness & preventive care aren’t covered.

- Expensive options: a $35 enrolment fee and 20% increase on premiums each year.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Per-Incident Deductible | $500 | $500 | $500 |

| Annual Limit | Unlimited | Unlimited | Unlimited |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $47.94 | $66.91 | $98.45 |

9. GEICO

- AM Best Rating: A+

- BBB Rating: A+

GEICO is one of the leading insurance companies in today’s world. Their offers include a wide variety of plans across multiple industries. GEICO’s pet insurance plans are provided through Embrace.

Pros

- Excellent wellness plans;

- Flexible options for annual deductible;

- Discounts for military members and their families;

- Cancer plans;

- Lower deductible if you don’t submit a claim during the year;

- Around the globe insurance;

- Discounts for multiple cats.

Cons

- Pre-existing conditions are not covered;

- Limited accident coverage;

- $25 entry fee and $1 monthly transaction fee.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $500 | $500 | $500 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $62.33 | $45.29 | $36.88 |

10. Bivvy

- AM Best Rating: A

- BBB Rating: N/A

If you’re up for an affordable cat insurance plan offered by a young company that’s trying to find its place on the market, try Bivvy.

Although good for starters, Bivvy offers a low reimbursement rate and is quite limited on claim payout, so it might not be suitable for everyone.

Pros

- Full bilateral coverage;

- Monthly premiums start at $9/month and $15/month;

- A very affordable wellness plan;

- No veterinary exam required for enrollment;

- Coverage for hereditary and congenital conditions, endodontic treatments, and euthanasia.

Cons

- Limited state coverage;

- 50% reimbursement rate;

- No dental coverage;

- No preventive care plan;

- No options for annual deductibles;

- Low annual limits ($1000 – $5,000);

- Low lifetime limit ($25,000).

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | Connecticut | Oregon | Texas |

| Per-Incident Deductible | $100 | $250 | $100 |

| Annual Limit | $2,000 | $3,500 | $2,000 |

| Reimbursement | 50% | 50% | 50% |

| Monthly Premium | $11 | $11 | $15 |

11. AKC Cat Insurance

- AM Best Rating: A-

- BBB Rating: A+

The AKC has been promoting responsible cat ownership for over a century. Now, in partnership with PetPartners, they also offer cat insurance to AKC customers.

With various options to choose from and several discount options, AKC members can find the AKC Pet Insurance policies most suitable for maintaining the wellbeing of their purebred cats.

Pros

- Discount options for AKC members;

- Free 30-day insurance policy for AKC members;

- A very low per-incident payout limit with a Basic Coverage plan;

- Custom Coverage plan with options for unlimited payouts;

- Optional add-ons for wellness, exams, hereditary conditions;

- No veterinary exam required for enrollment.

Cons

- No plan for bilateral conditions;

- High monthly transaction fees;

- An age limit regarding illness coverage.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | Unlimited | Unlimited | Unlimited |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $42.13 | $48.19 | $59.53 |

12. USAA Pet Insurance

- AM Best Rating: A+

- BBB Rating: A+

USAA Insurance’s plans are administered by Embrace. This includes everything that Embrace has to offer, plus a special discount on their services if you order through USAA. Let’s recap the highlights:

Pros

- No age limit;

- Around the globe insurance;

- A 48 hour waiting period for accident claims;

- A 15% discount on Insurance policies if you’re a USSA member;

- Coverage for curable pre-existing conditions;

- Wellness plan available;

- Accident-only plan available.

Cons

- Monthly transaction fees;

- No plan coverage for cosmetic procedures, such as tail docking, ear cropping, and dewclaw removal;

- An age limit regarding illness coverage; accident-only coverage.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $500 | $500 | $500 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $62.33 | $45.29 | $36.88 |

13. Petplan

- AM Best Rating: A+

- BBB Rating: A–

Petplan regularly updates its cat insurance policies in an effort to provide the latest and greatest deals on the market concerning healthcare coverage. They have a dedicated team that follows your cat’s progression through routine check-ups so that they can learn more about its traits and offer what’s best for their health long term.

At this time, Petplan is one of the few insurance companies to offer COVID-19 coverage for cats. Their End of Life policy is also one of the most recognizable and thought-through features.

Pros

- COVID-19 coverage and reimbursement for online vet visits;

- No limits on age;

- No annual, or lifetime limits;

- 30-day money-back guarantee;

- Emergency situation coverage.

Cons

- Strict eligibility control – to claim coverage, your cat must be checked at a vet within 48 hours regarding the problem at hand.

- No plans for wellness and preventive care.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $300 | $300 | $300 |

| Annual Limit | $15,000 | $15,000 | $15,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $24.84 | $35.06 | $88.88 |

14. Petco

- AM Best Rating: A

- BBB Rating: B

Petco specializes in supplying food, supplements, and prescriptions for cats. They have a devoted grooming and training team, as well as adoption and sitting service departments. As of late, they have begun offering insurance plans and policies.

With reasonable prices and proper accident and illness coverage, they are looking to become a staple in the cat insurance industry.

Pros

- A grooming and training plan;

- Flexible plans covering accidents and illness;

- Reimbursement rates up to 90%;

- Direct vet bill payment;

- Free pet concierge service is included with every plan.

Cons

- No plans for wellness and routine care;

- Void reimbursement on certain types of pre-existing conditions.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $40.44 | $38.62 | $79.98 |

15. State Farm

- AM Best Rating: N/A

- BBB Rating: A

State Farm’s cat insurance policy is being administered by Trupanion. They offer a ‘second to none’ dental care and bilateral conditions coverage, as well as direct vet bill payments.

Here is an overview of some of the pros and cons:

Pros

- Direct vet bill payment option;

- Coverage plans for physical therapy, acupuncture, hydrotherapy, and behavioral therapy

- 90% reimbursement rate;

- Coverage for bilateral conditions;

- Dental care insurance.

Cons

- Among the most expensive insurance providers;

- No wellness plans available;

- Per-incident deductibles only;

- Age restrictions.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Per-Incident Deductible | $500 | $500 | $500 |

| Annual Limit | Unlimited | Unlimited | Unlimited |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $47.94 | $66.91 | $98.45 |

16. Hartville

- AM Best Rating: A

- BBB Rating: A+

Hartville is an insurance company that offers comprehensive cat policies while keeping things simple and easy to navigate and understand.

They also offer a dedicated app that lets you track everything and stay in the know with all the latest policy and plan updates.

Pros

- Preventive Care coverage;

- Accident-Only coverage available;

- An all-inclusive app through which you can be on top of everything; submit claims, set up your direct deposit, pay your vet bill, and even locate nearby vet clinics;

- A lot of options to choose from when it comes to deductibles and reimbursement.

Cons

- Doesn’t have as many features as some of the other companies;

- Limited reimbursement for Preventive Care plans;

- Senior cat coverage exponentially grows each year.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $500 |

| Annual Limit | $5,000 | $5.000 | $5,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $28.53 | $27.25 | $51.67 |

17. PetFirst

- AM Best Rating: A-

- BBB Rating: A+

With a history of more than fifteen years and a proven track record, PetFirst has been among the leading companies when it comes to cat insurance. After six months, your cat becomes eligible for coverage for intervertebral disc disease (IVDD), anterior cruciate ligaments, medical cruciate, posterior, cruciate ligaments, and cranial cruciate ligaments.

PetFirst are known for their wide range of customizable plans, dealing with everything; from ailing kittens to senior cats.

Important: After 2 years of being acquired by MetLife, PetFirst has finalized its rebranding into the new company. Existing policyholders will retain the same coverage conditions as they did during their time with PetFirst. From now on, new customers will be redirected to MetLife’s website and obtain pet insurance policies through them.

Pros

- No waiting period for accidents coverage;

- Illness coverage becomes available after a two week waiting period;

- An option for very low deductibles;

- A customizable routine care plan;

- Discounts for vet clinics and animal specialists.

Cons

- No accident-only coverage option;

- Only a 14-day free look period (compared to the 30-day free look period offered by some of the other cat insurance companies on the market);

- The Routine Care plan is limited to scheduled benefits.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $500 |

| Annual Limit | $5,000 | $5,000 | $5,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $27.70 | $22.46 | $36.76 |

18. Pets Best

- AM Best Rating: Unrated

- BBB Rating: A+

Founded by Dr. Jack L. Stephens, who goes by the moniker, “the father of the pet insurance industry”, Pets Best offers comprehensive and affordable cat insurance plans that have appealed to cat owners since 2005.

Pros

- 30-day money-back guarantee;

- Flexible accident and illness plans;

- Two tiers for preventive care coverage;

- No age restrictions;

- No payout restrictions for lifetime coverage;

- Direct vet bill payment;

- An around-the-clock hotline;

- Discounts for multiple pets.

Cons

- Routine wellness and preventive care are not covered.

- Exclusions for bilateral conditions, cremation, burial, and alternative therapies.

- Some of the claims have had prolonged waiting periods.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | Unlimited | Unlimited | Unlimited |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $31.68 | $24.28 | $95.89 |

19. 24PetWatch

- AM Best Rating: A

- BBB Rating: A+

24PetWatch are among the top of the cat insurance industry because they’re expeditive, offer customizable plans, are very thorough, and aim to develop a one-to-one, personal relationship with their customers.

As 24PetWatch is among the most popular insurance choices for cat owners, according to their website, last year they paid out over $42 million in reimbursements.

Pros

- Short waiting periods on claim processing;

- Hereditary and congenital conditions are covered;

- Coverage for alternative treatments, hospitalization, and surgeries;

- Coverage for emergencies such as boarding kennel fees and lost pet recovery costs;

- Their insurance policies are very flexible;

- Coverage for curable pre-existing conditions after being symptom-free for two years.

Cons

- High monthly premiums;

- High monthly transaction fee;

- No unlimited plans;

- An age limit for senior cats.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Per-Incident Deductible | $250 | $250 | $250 |

| Annual Limit | $5,000 | $5,000 | $5,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $39.42 | $29.56 | $38.01 |

20. Prudent Pet

- AM Best Rating: A

- BBB Rating: A+

Founded in 2018, Prudent Pet has managed to climb the ranks like no other company and secure the number one spot on Trustpilot when it comes to reviews for pet insurance providers despite their relatively short tenure.

They also offer accident-only and accident and illness pet insurance policies that are customized to every cat’s individual needs.

Pros

- 30-day free look period;

- #1 pet insurance company on Trustpilot;

- No age restrictions;

- Unlimited claim payout coverage;

- Accident and illness coverage;

- Accident-only plans available;

- Affordable wellness programs;

- Around the clock Vet hotline;

- A ten percent discount for multiple cats.

Cons

- Exclusions for bilateral conditions;

- Exclusions for alternative and holistic therapies.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $500 | $500 | $500 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $25.70 | $29.71 | $54.97 |

21. SPOT

- AM Best Rating: A

- BBB Rating: B

Founded in 2019, SPOT is among the new kids on the block. They provide customizable coverage when it comes to accidents, illness, and preventive care and set no limits on enrollment for senior cats. They also provide a wide array of options regarding alternative and behavioral therapy coverage.

Pros

- 30-day money-back guarantee;

- An around-the-clock medical helpline;

- A ten percent discount for multiple cats;

- Customizable accident and illness plans;

- Thorough preventive care plans;

- Eligible to enroll without a vet exam;

- Alternative therapy coverage.

Cons

- Bilateral conditions are not included;

- Relatively high prices for complete coverage.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $5,000 | $5,000 | $5,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $28.53 | $27.25 | $51.67 |

22. PetPartners

- AM Best Rating: A-

- BBB Rating: A+

PetPartners was founded in 2002. It has been providing dependable pet insurance for the past eighteen years. They offer you the chance to build your own policy as you see fit and provide a complete refund if their services do not meet your standards within the first month.

Pros

- A TrailTrax® app for accessing medical records, discovering vet clinics and cat parks, and getting discounts at partnering businesses.

- One of the most affordable monthly premiums in the cat insurance industry regarding basic accident and illness coverage;

- Customizable plans regarding illness, Inherited & Congenital, Exam & Office Visits, and Memorial coverage;

- Around-the-clock vet helpline by a specialized customer care team.

Cons

- The Basic Coverage plan is quite affordable, but it does not cover exam fees and hereditary conditions;

- Limited age coverage options.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $500 |

| Annual Limit | Unlimited | Unlimited | Unlimited |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $42.13 | $34.74 | $59.53 |

23. PetPremium

- AM Best Rating: A

- BBB Rating: A+

With PetPremium what you see is what you get. They pride themselves on their straightforward approach, offering transparent pricing and insurance plans while building a fully integrated health platform from the ground up.

The company has a foresighted approach, focusing on preventive care and wellbeing.

Pros

- Low annual deductibles;

- Offer two distinctive plans for Preventive Care, health monitoring and promoting healthy practices;

- A vast and extensive knowledge base available at your fingertips;

- Accident-only coverage.

Cons

- No unlimited claim payouts;

- Some of their plans lean on the more expensive side;

- Not all claims have been approved straight away.

24. Pumpkin

- AM Best Rating: A

- BBB Rating: N/A

Awarded “Best Pet Insurance for Comprehensive Coverage” by Business Insider in 2020,

Pumpkin is considered one of the best new cat insurance providers on the market. Their rise is especially impressive because they were founded in April of 2020.

Their policies cover dental illnesses, behavioral issues, hereditary conditions, parasite infections, in-clinic and virtual veterinary exams, accidents & illnesses, physical therapy, and prescription food & supplements at no extra cost.

Pros

- One of the best illness coverage around;

- Customer support by a cat-loving care team;

- 90% reimbursement rate;

- Curable chronic conditions coverage;

- Comprehensive and regular data analysis;

- Donations to vet clinics across the country.

Cons

- No unlimited payout options;

- The jury is still out on Pumpkin because they do not have a proven track record.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $500 | $500 | $500 |

| Annual Limit | $15,000 | $15,000 | $15,000 |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $39.22 | $36.70 | $74.66 |

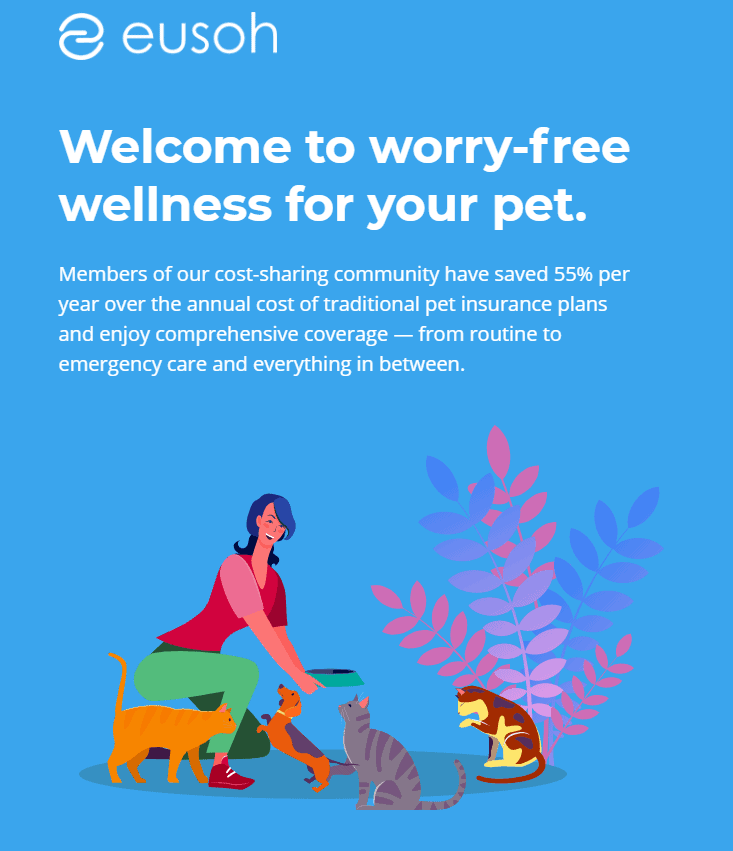

25. Eusoh

- AM Best Rating: N/A

- BBB Rating: A+

Eusoh differs from other insurance companies because they offer a community health sharing plan that reimburses you for your pet’s medical bills, wellness, illness, and routine care expenses.

They get their revenue from the membership fees. They do not access the finances that flow between all of the community members and do not take a percentage from that pool.

Basically, Eusoh’s plan is community-funded. You participate with a monthly fee and enter a fund from which you’re reimbursed for 80% of your vet bill.

Pros

- Affordable monthly fees;

- Community-based funding;

- No age restrictions for senior cats;

- Plans for accidents, illnesses, wellness, and routine care expenses.

Cons

- A thirty-day waiting period on policies;

- You cannot sign up for a membership for less than a year so that an annual budget can be established.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $8.500 | $8.500 | $8.500 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $65 | $65 | $65 |

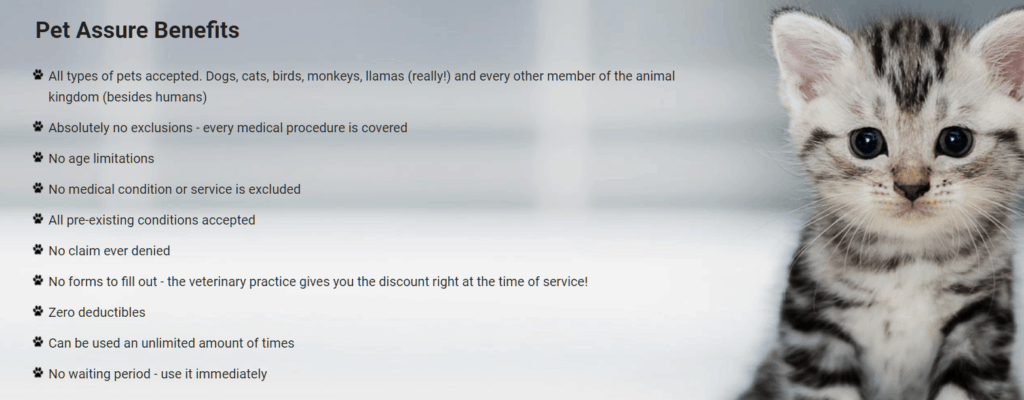

26. Pet Assure

- AM Best Rating: N/A

- BBB Rating: A+

Once you register your cat at Pet Assure, you are eligible for reimbursement, and since Pet Assure isn’t an insurance company, there are no exclusions, no forms to fill out, and no deductibles to meet. You just need to visit a participating vet and be reimbursed at checkout.

Pet Assure is active in all 50 states, along with Puerto Rico and Canada.

For a one-time monthly fee, you can get a 25% discount at most veterinary clinics in the country.

There are no exclusions for pre-existing conditions like allergies, periodontal disease, hereditary conditions, hip dysplasia, or diabetes.

Pros

- Full coverage for pre-existing conditions;

- 25% discount at every participating vet clinic;

- No restrictions when it comes to the cat’s age;

- No annual limits, deductible, and waiting periods;

- A relatively low monthly fee;

- 45-day money-back guarantee.

Cons

- Not applicable at every vet clinic;

- No coverage for grooming and prescriptions.

Pricing Quotes

With Pet Assure you get a 25% discount on your vet bill at any participating vet clinic.

27. Allstate

- AM Best Rating: A+

- BBB Rating: A+

Allstate is a big name in the insurance industry dealing in everything from home, renters, auto, life, and business insurance. They have partnered with Embrace to provide cat insurance that everyone can use, regardless if they are in the states or abroad.

Let’s take a closer look at what they have to offer:

Pros

- Accident-only coverage plans;

- Coverage for curable pre-existing conditions;

- Annual deductibles;

- Wellness coverage plans;

- Coverage anywhere in the world.

Cons

- Bilateral and pre-existing conditions aren’t covered;

- No illnesses coverage for senior cats;

- A relatively high enrollment fee, plus a monthly transaction fee.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $500 | $500 | $500 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $62.33 | $45.29 | $36.88 |

28. MetLife

- AM Best Rating: A-

- BBB Rating: A+

MetLife is another insurance juggernaut providing and administering its pet insurance through the services of PetFirst since 2019, when they expanded and entered the cat insurance industry.

PetFirst’s policies are primarily catered towards employees who want to use cat insurance as a job benefit.

Pros

- No waiting period for accidents claims;

- A two week waiting period for illness claims;

- Routine care coverage available;

- A variety of plans for kittens and senior cats;

- Deductible decreases $25 annually if no claim has been made;

- Various discounts;

- Insider cat health guides and tips.

Cons

- Lower reimbursement payouts on some plans;

- No plans for accident-only coverage;

- A two-week money-back guarantee.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $500 |

| Annual Limit | $5,000 | $5,000 | $5,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $27.70 | $22.46 | $36.76 |

29. Costco Cat Insurance

- AM Best Rating: A

- BBB Rating: A+

Costco Pet Insurance is a dedicated cat health care coverage company directed at the Canadian market.

Costco has partnered with Pets Plus Us to deliver cost-effective cat insurance to Canadian cat owners. They have put together a group of insurance products and services that make being a cat parent worry-free.

Pros

- Emergency medical coverage plans available;

- Wellness coverage plans available;

- Accident-only coverage plans available;

- A Blue Ribbon Benefits program that has extra offers and perks;

- All-around coverage for all cat types, regardless of breed;

- 4Life Guarantee;

- Special discounts for Costco members.

Cons

- The Costo cat Insurance policies are limited to the Canadian market;

- No option for digital claims;

- No unlimited claim payouts.

30. AAA Cat Insurance

- AM Best Rating: A++

- BBB Rating: A+

AAA’s plans are administered by Healthy Paws. They cover everything from illnesses, injuries, and emergencies to hereditary conditions and insurance transfers; everything that Healthy Paws has to offer, plus a special discount on their services if you order through AAA.

Here are some of the pros and cons:

Pros

- 5% off if you go through AAA;

- Direct vet bill payment;

- The average claim processing is 48 hours.

- No per-incident, annual, and lifetime limits on coverage;

- Charity work for cat shelters and homeless animals;

- Annual deductibles;

- Option to your policy transfer to another person without interruption;

- Regular donations on every quote for homeless animals.

Cons

- The examination fees for pre-existing conditions and preventative care are not covered.

- The plan does not reimburse the costs, fees, or expenses associated with elective procedures, boarding, behavioral modification, training, therapy, or medications for behavioral modification.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 6 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | Unlimited | Unlimited | Unlimited |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $26.24 | $35.11 | $31.85 |

31. AARP Cat Insurance

- AM Best Rating: A+

- BBB Rating: A+

AARP’s plans are administered by Petplan. They provide additional benefits and special discounts to their members. They have a dedicated team that follows the progression of your cat and offer COVID-19 coverage and reimbursement for online vet visits.

AARP members who are retirees get up to a 10% discount on Petplan’s cat insurance policy plus a $35 prepaid Visa card.

Pros

- AARP members receive up to 10% discount;

- Full coverage for cat’s accidents and illnesses;

- No age, annual, and lifetime limits;

- No annual, or lifetime limits;

- 15% off on monthly premiums if no claims have been made during the year;

- 30-day money-back guarantee.

- Emergency situation coverage.

Cons

- Strict eligibility control – to claim coverage, your cat must be checked at a vet within 48 hours regarding the problem at hand;

- No plans for wellness and preventive care;

- Coverage restrictions based on age.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $300 | $300 | $300 |

| Annual Limit | $15,000 | $15,000 | $15,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $24.84 | $35.06 | $88.88 |

32. Liberty Mutual

- AM Best Rating: A

- BBB Rating: A+

With more than 100 years of insurance experience, Liberty Mutual offers highly customizable coverage so you only pay for what you need. You get to choose your annual coverage amount, select the percentage of how much you’ll get reimbursed for each vet visit, and your annual maximum. Also, you retain the flexibility to use any vet and there are no monthly transactions or administration fees.

Pros

- Highly customizable plans;

- Flexible accident, illness, and wellness plans,

- Coverage for hundreds of conditions;

- Discount of up to 10% for multiple cats.

Cons

- Relatively long claim processing;

- Expensive monthly premiums for complete cat healthcare coverage.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $500 | $500 | $500 |

| Annual Limit | $10,000 | $10,000 | $10,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $35.66 | $30.03 | $33.82 |

33. VCA

- AM Best Rating: N/A

- BBB Rating: A+

With 35 years of experience, the Veterinary Centers of America don’t offer cat insurance in the traditional form, but rather professional wellness care for one flat monthly fee. Their hospitals provide a full range of general, surgical, and specialized care.

Pros

- Complete wellness coverage including spaying and neutering, unlimited exams, dental coverage, and vaccines regardless of breed;

- Subscription starts at $50/month;

- Discounts of up to 25%;

- Available in Canada;

- Around-the-clock vet helpline through the myVCA app.

Cons

- VCA’s services have varied, depending on location;

- No coverage for injuries or illnesses.

Pricing Quotes

Memberships for wellness coverage at a VCA Center start from $50/month.

34. Lemonade

- AM Best Rating: A

- BBB Rating: N/A

With just over six months since they offered their first cat insurance policy, Lemonade is definitely the new kid in town. In this short period, they have received a lot of positive feedback as their insurance policies are at the forefront of the latest industry standards.

Powered by artificial intelligence, they offer one of the most all-encompassing wellness care plans on the market. They cover blood tests, urinalysis, x-rays, MRIs, labwork, CT scans, ultrasounds, emergency care, hospitalization, surgery, infections, cancer, heart disease, diabetes, allergies, arthritis, skin conditions, elbow & hip dysplasia, hernias, blood, & eye disorders, among others.

Pros

- Transparent pricing and policies;

- Policy building and claim processing are handled by artificial intelligence;

- Low monthly premiums;

- No limits on lifetime claims;

- Annual deductibles;

- If bundled with their home insurance plans you get 10% off, on your cat insurance policy.

Cons

- Don’t offer full US coverage;

- Limits for senior cats;

- Behavioral therapy, microchipping, and final respects expenses aren’t covered.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Texas | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $20,000 | $20,000 | $20,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $28.42 | $43.25 | $45.75 |

35. APIC Cat Insurance

- AM Best Rating: N/A

- BBB Rating: A+

The American Pet Insurance Company is the umbrella for four of the leading cat insurance providers in the industry; Trupanion, AKC cat Insurance, Pets Best, and PetPartners.

APIC allows its partners to focus on their distribution channels while providing them with management and leverage by utilizing their core skills and strengths.

Pros

- No age restrictions, except for Trupanion, which doesn’t cover senior cats;

- Unlimited payout plans;

- Trupanion is geared towards veterinarians, Pets Best focuses primarily on consumers as an employment benefit, and AKC caters solely to their members;

- Short waiting periods for accident coverage;

- Various discounts depending on your plan.

Cons

- Monthly premium prices are highly affected by breed and age;

- $2 to $4 monthly transaction fees;

- No coverage for behavioral treatments.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $500 | $500 | $500 |

| Annual Limit | Unlimited | Unlimited | Unlimited |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $47.94 | $66.91 | $98.45 |

For more pricing options, take a look at AKC Cat Insurance, Pets Best, and PetPartners.

36. Wells Fargo Health Advantage

- AM Best Rating: N/A

- BBB Rating: N/A

Wells Fargo Health Advantage takes a different approach to cat insurance by offering a credit card program with a comprehensive range of financing options. Clients can use the Wells Fargo Health Advantage credit card program for many of their pets’ needs. This covers but is not limited to general veterinary practice care, treatment procedures, emergency clinic treatment and procedures, hospital care, as well as dental, allergy, and arthritis treatments.

Pros

- No waiting periods;

- No limitations on age or breed;

- No deductibles and monthly premiums;

- Coverage for Medical procedures, illnesses, accidents and wellness.

- Coverage for pre-existing and bilateral conditions.;

Cons

- Not enough information on how many or which vet clinics offer this program.

- With the Wells Fargo Health Advantage credit card, you’d need to pay the full price for any procedure. There are interest rates when you pay back the money and you won’t be reimbursed for any percentage of the vet bill.

Pricing Quotes

With the Wells Fargo Health Advantage credit card, you pay the full price of your vet bill and return the money in time with interest.

37. Banfield Pet Hospital

- AM Best Rating: N/A

- BBB Rating: A+

Banfield Pet Hospital doesn’t offer cat insurance in the traditional sense. Instead, they have plans for preventive care for kittens and cats.

Their Optimum Wellness Plans (OWPs) are relatively affordable year-long packages of preventive veterinary care designed to support your pet’s health. With an OWP, you pay monthly or annually for a package of services designed to deliver preventive care such as vaccines as physical exams.

Pros

- Transparent pricing;

- Coverage for pre-existing conditions;

- A variety of wellness plans; Early Care, Early Care Plus, Active Care, Active Care Plus, and Special Care;

- Coverage for physical exams, vaccinations, virtual cat care service, dental cleaning, urine testing, preventive x-rays, and more;

- No waiting periods;

- Members get a $15 discount for every additional cat;

- Banfield hospitals operate during weekends and night hours.

Cons

- Relatively high monthly premiums;

- A relatively high entry fee;

- No coverage for injuries and illnesses.

Pricing Quotes

Memberships at Banfield Pet Hospital depend on your cat’s age, breed, size, and location.

38. AAHA Cat Insurance

- AM Best Rating: A+

- BBB Rating: A+

The AAHA represents one of the most renowned and reliable organizations in the world. Founded by veterinary professionals in 1933, the founders were convinced that small-animal practice was important and that it was necessary to provide better facilities and methods than the ones that were generally available. Since then, the American Animal Hospital Association has focused on raising the bar in terms of industry standards.

Their cat insurance plans are administered in partnership with Petplan.

Pros

- 30-day free look period;

- Coverage for injuries and illnesses conditions;

- No age, annual, and lifetime limits;

- Coverage for vacation cancelation and lost or stolen pet;

- Discounts for military members, veterinary professionals, and students.

Cons

- Relatively high monthly premiums;

- Reimbursement claims are valid only if they have been submitted 48 hours after your cat has been injured or displayed symptoms;

- Limited coverage for senior cats.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $300 | $300 | $300 |

| Annual Limit | $15,000 | $15,000 | $15,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $24.84 | $35.06 | $88.88 |

39. Wagmo

- AM Best Rating: A

- BBB Rating: N/A

At Wagmo there is a clear distinction between Pet Wellness and Pet Insurance. Wagmo Wellness is not an insurance policy provider and is distinct from their insurance plans. Customers may purchase either product on a standalone basis and pick only what they need.

Wellness plans start at $20/month, while Insurance plans start at $13/month.

Pros

- Coverage for bilateral conditions, such as hip dysplasia in pets younger than 6 years old;

- Grooming and dental care have no waiting periods;

- Simple pricing structure;

- Claims are processed within 24 hours;

- 100% reimbursement.

Cons

- Accident and illness coverage plans aren’t available in every state;

- Spaying, neutering, and behavioral therapy aren’t covered.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $1000 | $1000 | $1000 |

| Annual Limit | $20,000 | $20,000 | $20,000 |

| Reimbursement | 100% | 100% | 100% |

| Monthly Premium | $66.54 | $58.17 | $61.47 |

40. Odie

- AM Best Rating: A- and B+

- BBB Rating: N/A

Odie is one of the newer cat insurance providers in the industry, offering up-to-date coverage for all cats; there are no breed or age limits and their customizable plans are optimized for every budget.

Let’s take a closer look at what they have to offer:

Pros

- Highly-customizable plans;

- Add-ons for Office Visits & Exam Fees; Take-Home Prescription Medications; Rehab, Acupuncture, & Chiropractic Care; Routine Care Plans.

- No waiting periods and no deductible for the routine care plans;

- No age and breed restrictions;

- An around the clock Self-Service Portal;

- 5-day digital claim processing.

Cons

- Relatively high all-inclusive premiums;

- No coverage for spaying/neutering, behavioral therapy, and alternative treatments.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $500 | $500 | $500 |

| Annual Limit | $40,000 | $40,000 | $40,000 |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $24.55 | $32.76 | $52.41 |

41. Companion Protect

- AM Best Rating: A

- BBB Rating: N/A

Companion Project offers relatively affordable premiums that aren’t affected by your pet’s age. Their plans feature low deductibles and copays and are easy to understand, so you’ll know exactly what you’re up for.

Although their cat insurance policy is valid at every veterinarian clinic in the country, Companion Protect has their own network of vet clinics – Vetwork – where you get additional benefits and more bang for your buck.

Pros

- No waiting periods;

- No age and breed restrictions;

- $50 deductible with Vetwork clinics;

- Pre-existing conditions are listed on the health certificate that you receive after your cat has been examined so that you know exactly what your plan does and doesn’t cover.

- 90% reimbursement with Vetwrok clinics;

- 50% coverage for prescription food;

- 15% discount for multiple cats, military, and animal welfare centers.

Cons

- Strict approvals prior to enrollment;

- No wellness coverage available;

- Companion Protect insurance plans lack flexibility.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $50 | $50 | $50 |

| Annual Limit | $100,000 | $100,000 | $100,000 |

| Reimbursement | 90% | 90% | 90% |

| Monthly Premium | $35.99 | $27.99 | $35.99 |

42. TrustedPals

- AM Best Rating: A+

- BBB Rating: N/A

TrustedPals offers customizable plans for all budgets, so you can select your annual limit, reimbursement, and deductible that target your needs.

They cover both in-house procedures and stuff you take home with you. Also, they’re donating 1% of all profits to help pets without homes and ones affected by natural disasters.

Pros

- A wide array of options when customizing your accident and illness insurance plan; annual deductibles ranging from $0 to $750; annual claim payout options ranging from $4,000 to unlimited; reimbursement percentage ranging from 70% to 100%.

- Coverage for vet prescriptions at no extra cost;

- Option for wellness insurance available;

- Discounts for multi-pet, military, vets and first responders.

Cons

- No plans for grooming and boarding coverage;

- The wellness plan has an annual coverage is limit of $750;

- No preventive care coverage unless you have the wellness plan.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | New York | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $8,000 | $8,000 | $8,000 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $49 | $40 | $50 |

43. Pawp

- AM Best Rating: N/A

- BBB Rating: N/A

Pawp takes an alternative approach to cat insurance and states that all pets are protected in the event of an emergency, even if that emergency relates to pre-existing conditions. Once a certified veterinarian confirms that your cat is indeed in an emergency situation, you gain access to a $3000 fund to cover the expenses.

- Plans for pre-existing conditions;

- Direct vet bill payment;

- Policies regarding poisoning, choking, difficulties while breathing, severe blockages, seizures, and severe injuries;

- Cover up to six pets with one plan;

- No copay and no deductible;

- Affordable membership.

Cons

- The emergency fund is accessible only after a video call with a veterinarian;

- Coverage is limited to only one emergency per year;

- No plans for illnesses and preventive care including scheduled surgeries, regular check-ups and wellness visits, vaccinations & routine procedures, pregnancy and pregnancy-related Issues

Pricing Quotes

Pawp’s emergency coverage costs $19/month and covers one emergency per year for up to $3,000.

44. Toto

- AM Best Rating: A-

- BBB Rating: A+

Last but certainly not least is Toto, founded by pet parents over 30 years ago. They provide expertise and cover accident or illness-related vet exam fees, but also breed-specific inherited conditions such as heart disease, cancer, acupuncture, chiropractic, hydrotherapy, and hip dysplasia.

Pros

- Preventive care plans;

- A variety of plans that cover accidents and illnesses;

- Customizable plans for reimbursement, deductible, and payout limits ;

- Fast claim processing;

- 20% of the profit is donated to animals in need.

Cons

- Breeding, grooming, parasites, and experimental treatments aren’t covered;

- End-of-life expenses for senior cats aren’t covered;

- Hereditary and congenital conditions for senior cats aren’t covered.

Pricing Quotes

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Age | 2 | 4 | 8 |

| Gender | Male | Male | Female |

| State | Texas | Colorado | California |

| Annual Deductible | $250 | $250 | $250 |

| Annual Limit | $7,500 | $7,500 | $7,500 |

| Reimbursement | 80% | 80% | 80% |

| Monthly Premium | $24.92 | $39.33 | $62.28 |

Why Do You Need Cat Insurance?

We believe that most cat owners would agree that their favorite mouser deserves the very best when it comes to its health and wellbeing. Cat insurance policies cover a wide array of problems that might come up, such as unexpected veterinary fees, surgery, homecare in case the owner is unable to provide it, further care in case of an accident or illness, locating strays, as well as routine preventative care measures, vaccinations, and checkups.

What Should You Consider When Choosing Your Insurance Plan?

The Price Point

The excess point. Take a good look if the plan has a certain cap, limit, or is sold as an unlimited plan. Depending on the policy, there will be different threshold curves by which, once a claim is made, a fixed amount or a percentage is deducted from the final cost. These fixed amounts and percentages vary from provider to provider, and from policy to policy.

The Waiting Period

The waiting period is one of the most important things that you should be looking into when considering your plan; it represents the number of days from when you file your policy to when you are eligible to make a claim. This can be anywhere from ten days, up to a month. The policies do not cover anything during this waiting period. So, keep an eye on that.

The Age Limit

This only applies to your registration. Almost all insurance policies have an upper limit past which you can’t be insured because of old age.

Pre-Existing Conditions

If your cat has pre-existing conditions such as injuries or long-standing illnesses, the insurance policy will not cover these pre-existing conditions and you will not be able to file a claim for them if they persist or surface in the future.

tIt’s a good rule of thumb to do a complete checkup of your feline before looking into this because there might be underlying illnesses and potential problems that you’re not aware of, especially if you haven’t taken the time to look into it before, because there haven’t been any indications that something might be wrong.

It’s important to note that if you have run out of cover for a certain condition with your policy, switching to a new policy, regardless if it’s with the same or a different provider, the existing condition will be qualified and treated as pre-existing because it predates the new plan and will not be included with the new policy plan.

Types of Cat Insurance

Every company on our list offers a combination of the following types of cat insurance:

- Accidents coverage – these plans are usually the most affordable ones but they only deal and cover accidents and injuries.

- Illnesses coverage – a plan that covers all the medical bills in case of a disease.

- Wellness care – preventative care, covering everything from routine checkups and vaccinations to flea treatments and massages.

- End-of-life coverage – deals that cover the fees of taking care of your beloved feline when it’s time to say goodbye.

- Dental healthcare – all aspects of your mouser’s oral health.

- Emergency situations coverage – when you are unable to deal with an unexpected situation or condition.

- Alternative therapies coverage – unconventional ways of healing, including holistic and chiropractic treatments and acupuncture, to name a few.

Most of the providers will give you the option to combine several of these options or design your own custom plan.

How to Choose Your Cat Insurance Plan

It’s easy to get lost among the thousands of plans and policies, but making the right decision could and will save you a lot of time, money, and potentially lives. You need coverage that’s suitable for your cat’s needs. At the same time, you don’t want to overpay for services and features that you’ll never need.

Going through our list will give you a comprehensive overview of what’s out there and hopefully make it easier for you to choose, once the time is nigh. Take a close look at your cat’s breed, medical history, size, age and compare those parameters across the insurance providers that are up your alley.

Here’s what you need to look for when choosing an insurance company.

What’s the Company Rating?

You have probably spotted the included AM Best and the BBB ratings before the overviews of every company on the list. These indicate how a company ranks and performs within the cat insurance industry.

The AM Best Rating indicates a company’s strength and adherence. The higher the grade, the safer the option for financial reimbursement. Grades can range anywhere from poor (D) to superior (A++).

The BBB Rating indicates the company’s reliability; the standing of trust and confidence it has gained with the Better Business Bureau. This rating has to do with complaint resolution and how much effort the company in question puts into it. Companies are graded on a scale from F to A+.

Additionally, sites such as Truspilot.com, Sitejabber.com, or Reviews.io can provide great personal insight of the way a company performs and behaves from a user’s viewpoint.

What Type of Coverage Does the Company Provide for Your Cat?

Take a close look at the “What We Cover” and “What We Don’t Cover” lists when considering an insurance company. There you’ll find what the company can offer you in terms of coverage, different conditions, accidents, and emergencies.

Pre-existing conditions are almost always excluded from insurance policies in one way or another. Some of these conditions are reevaluated and revoked if no symptoms are displayed within six to twelve months while others aren’t. Most companies also have some sort of restrictions when it comes to age and even breed, or take these into account when calculating their monthly premium.

How Much Coverage Can You Get and What Are the Limits?

Pay special attention to the conditions and limitations listed on the insurance policies. You have to know exactly what you’re getting yourself into and how much and what the insurance company will cover.

- Reimbursement Percentage – If the reimbursement rate is listed at 90%, that means that you’ll need to cover 10% and the company will handle the rest. If the reimbursement percentage is listed at 60%, then you’ll need to cover 40% of the expenses. However, this is usually directly linked to the other categories listed below, as well as the final price of your monthly premium.

- Annual Limits – The annual limit represents the amount that you can be reimbursed for on a yearly basis. Some companies and plans don’t have a threshold and offer unlimited annual payouts.

- Lifetime Limits – Much like the annual limit, the lifetime limit is the payout cap that you can be compensated for during your cat’s lifetime. Most companies don’t impose a lifetime limit, but some do and you might even want one if that corresponds with a relatively low monthly premium.

- Deductibles – Usually ranging between $250 and $750, but going as low as $0 and as high as $1,500, a deductible represents the fixed amount that most policies commit you to pay annually if you have submitted a claim within the span of a year. This, however, is not set in stone, as some insurance companies have and offer per-incident deductibles. In other words, you have to pay a certain amount every time your cat undergoes a medical procedure or a claim is made.

The more time you spend on considering all of the aspects, nuances, and details, the better the chance that you’ll come to a more informed decision. Sometimes choosing unlimited claim payouts with high reimbursement rates can turn out to be most beneficial in the long run even though it can cost you a higher monthly premium. It all depends on what you want and need.

Conclusion

At the end of the day, unfortunately, these are things that can’t be calculated and we believe that it’s reasonable to have some kind of a safety net when taking a leap of faith with a new insurance company.

The 44 listed companies above should provide you with a solid enough foundation to make the most out of your budget and weigh your needs and priorities against what the market has to offer.

If you want to learn more and gain insight into how different pet insurance companies operate and compare, you can head over to our Pet Insurance Cost Comparison article.

F.A.Q.

What are the most common cat medical conditions?

There are a lot of health problems that can potentially harm your cat, but the most common ones include feline lower urinary tract diseases, vomiting, fleas, tapeworms, diarrhea and eye problems such as conjunctivitis, corneal ulcer, cataracts, glaucoma, inflammation, and retinal disease.

Are pre-existing conditions covered with a cat insurance policy?

That depends on your plan but, usually, insurance companies exclude pre-existing conditions from their policies. However, there are instances when you can get coverage for chronic conditions, especially coverage for so called “curable pre-existing conditions”, meaning that a certain condition will be removed from the list of pre-existing conditions if your cat hasn’t displayed any symptoms relating to it for a certain amount of time; usually six to twelve months.

Is cat insurance worth getting?

We recommend that you seriously consider getting cat insurance because by doing so you could be potentially saving thousands of dollars, especially if you’re taking care of multiple pets.

Why do vets charge so much for treating a cat?

Veterinarian fees tend to be quite high because they encompass a plethora of things, including the vet’s skills, knowledge, time, expertise, equipment, and medication.